Beyond the Bank Balance | Creating Your Weekly Financial Review Routine

"I'll look at the numbers when my accountant needs them."

That's what Sara, a successful service business owner, used to say. Her business was doing well - revenue growing, clients happy. But every quarter brought surprises:

• Unexpected cash shortages

• Mystery charges

• Payment issues that had snowballed

💡 Success Story

Three months after starting a simple 30-minute Monday morning review routine, Sara:

- Caught a duplicate recurring subscription charge

- Spotted payment patterns that helped adjust payment terms

- Finally felt in control of her finances

Understanding Your Weekly Money Date

Why It Matters

Sara's story isn't unique. Meet Tom, another business owner who was "too busy" for regular reviews:

- Spent two days untangling books at tax time

- Discovered he'd been undercharging clients all year

- Could have saved thousands with 30-minute weekly reviews

✅ Quick Win

We recently explored The Five Essential Numbers Every Business Owner Needs to Track, but knowing what to track is just the start. Success comes from regular review and action.

Choosing Your Time

Both Sara and Tom found different times that worked for them:

- Sara: Monday morning coffee review

- Tom: Friday afternoon wrap-up

⭐ Key Point: The right time is the one you'll stick to consistently.

Schedule Tips:

- Choose a consistent day and time

- Consider your natural energy patterns

- Pick a time with minimal interruptions

- Allow enough time to take action on findings

💡 Pro Tip: Monday mornings set you up for the week; Friday afternoons help you close loops.

Setting Up for Success

Your Review Space

Sara turned her home office into a "money date headquarters," while Alex created a mobile setup for his on-the-go business. Both work because they're intentional about having the right tools at hand.

Physical Setup Essentials:

- Quiet workspace with good lighting

- Dual monitors or tablet as second screen

- Reliable internet connection

- Note keeping tools (digital or paper)

- File organization system

Digital Tools & Security

⚠️ Security First

- Never conduct reviews on public WiFi

- Use secure, password-protected internet

- Enable two-factor authentication

- Log out of all financial apps when finished

- Keep systems and apps updated

💡 Pro Tip from Sara: "I learned the hard way about public WiFi. Now I only do my money dates at home or using my phone's hotspot. The peace of mind is worth it."

Essential Software:

- Accounting software (logged in)

- Banking apps (bookmarked)

- Password manager

- Calendar for follow-ups

- Cloud storage for documents

Recommended Tools:

- Mute notifications

- Note-taking app (Evernote, OneNote)

- Scanner app for receipts (OneNote)

- 30-minute timer

Your Weekly Review Guide

The 30-Minute Framework

Here's how Sara breaks down her weekly review into manageable chunks:

1. Cash Position (5 minutes)

💰 Quick Check:

- Current bank balances

- Pending transactions

- Upcoming expenses

- Red flag items

"This quick overview gives me immediate peace of mind," Sara says. "I can spot potential issues before they become problems."

2. Receivables Review (5 minutes)

📊 Money Coming In:

- Overdue invoices

- Expected payments

- Follow-up needs

- Payment patterns

Tom's Tip: "Reviewing payment patterns helped me restructure payment terms with chronically late clients."

3. Payables Check (5 minutes)

💸 Money Going Out:

- Bills due this week

- Recurring payments

- Upcoming obligations

- Payment issues

4. Transaction Review (10 minutes)

✅ Keep It Current:

- Categorize new transactions

- Match receipts to purchases

- Flag unusual items

- Note missing documentation

Sara's Discovery: "This is where I caught that $300 monthly duplicate charge. It had been running for months!"

5. Action Items (5 minutes)

⭐ Next Steps:

- List follow-ups needed

- Schedule payment reminders

- Note team communications

- Plan next week's priorities

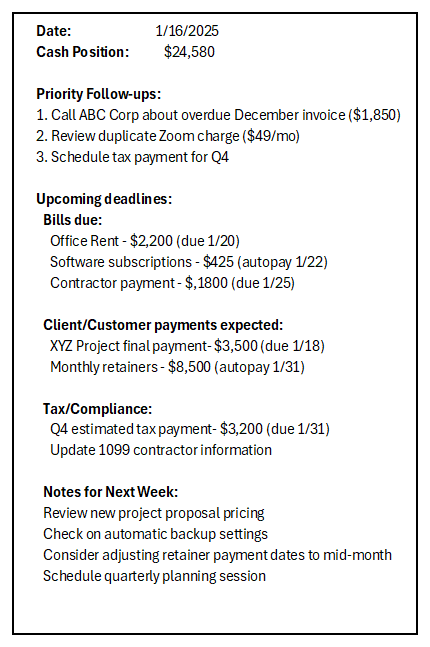

Sample Weekly Review in Action

Making It Work in Real Life

Different Approaches That Work

While Sara and Tom prefer dedicated time blocks, other business owners find different rhythms.

Meet Alex, who runs his business between client meetings and family time. His solution? Breaking the money date into power checks throughout the week:

"It's like checking the gas gauge in your car," Alex says. "You don't wait until you're stranded to look at it."

Alex's Power Check Schedule:

🌅 Monday Morning (10 mins)

- Quick cash position review

- Flag urgent items

- Set priorities for week

🌤️ Wednesday Afternoon (10 mins)

- Invoice check

- Bill review

- Quick follow-ups

🌅 Friday Before Lunch (10 mins)

- Transaction categorizing

- Weekly wrap-up

- Note items for Monday

Common Challenges Solved

⚠️ Challenge: "I keep forgetting"

✅ Sara's Solution: Paired money date with morning coffee routine

⚠️ Challenge: "It takes too long"

✅ Tom's Fix: Set up saved reports, cutting review time in half

⚠️ Challenge: "I'm not sure what I'm looking for"

✅ Alex's Approach: Started with just three numbers:

- Cash balance

- Money owed to him

- Bills due that week

⚠️ Challenge: "Something always comes up"

✅ Sara's Strategy: Treats it like any other important meeting - scheduled and protected

Real Results That Matter

Sara's Three-Month Transformation

✨ From quarterly surprises to weekly confidence:

- Caught $300 in monthly duplicate charges

- Improved cash flow with adjusted payment terms

- Reduced tax-time stress significantly

- Built confidence in financial discussions

Tom's Quick Wins

💪 Changes seen in just two weeks:

- Spotted underpriced services

- Updated pricing structure

- Increased profits by 20%

Alex's Flexible Success

🎯 His ten-minute power checks led to:

- Better cash flow management while traveling

- 70% reduction in overdue invoices

- Faster, more informed business decisions

Frequently Asked Questions

💭 Q: What if I miss a week?

A: Don't try to catch up on everything. Do a quick current review and start fresh next week.

💭 Q: Should I include my team?

A: Start solo to establish your routine. Add team members once you have a rhythm that works.

💭 Q: What if I find problems?

A: That's actually the goal! Finding issues weekly keeps them from becoming crises.

💭 Q: How detailed should I get?

A: Focus on high-level review and action items. Save deep dives for monthly reviews.

Ready to Take Control of Your Finances?

Your weekly money date isn't about becoming an accountant - it's about gaining clarity in your business decisions.

⭐ Start Simple:

- Choose your consistent time

- Set up your secure space

- Use our template

- Adjust as you go

While this routine will help you stay on top of your finances, some business owners find that partnering with a professional bookkeeper gives them even more time to focus on growth.

Whether you're ready to implement this system yourself or if you don't yet have your numbers available and you would like to explore professional support, the goal is the same: financial clarity and confidence. Let's talk about what approach would work best for your business.

📞 Call: (214) 306-7850 📧 Email: hello@mybizbookkeeper.com

Want a FREE Accounting Software Decision Tree Infographic? Subscribe to our weekly newsletter!