Cash vs. Accrual Accounting

Numbers shouldn't be overwhelming. Understanding the difference between cash and accrual accounting is like choosing between two different cameras to photograph your business – each captures your financial picture in its own unique way.

Why Understanding These Methods Matters

Choosing the right accounting method helps you:

- Make informed business decisions

- Plan for taxes effectively

- Understand your true financial position

- Meet legal requirements

- Scale your business properly

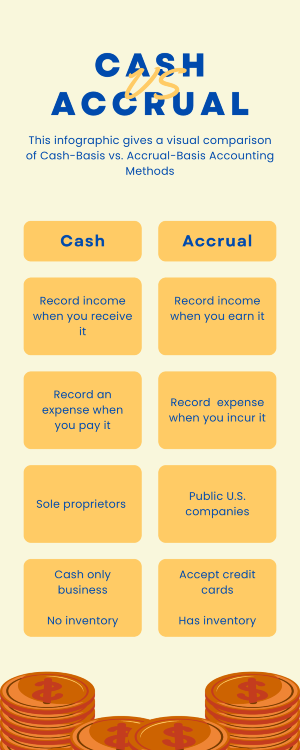

Cash-Basis Accounting: The Snapshot View

What It Is

Think of cash-basis accounting as your business's daily selfie:

- Records income when money is received

- Tracks expenses when money is paid

- Shows exact cash position

- Reflects real-time cash flow

- Simplifies record-keeping

Perfect For

- Small businesses

- Sole proprietors

- Service-based businesses

- Companies with immediate payments

- Businesses under $25M revenue

Accrual-Basis Accounting: The Complete Story

What It Is

Think of accrual accounting as your business's documentary film:

- Records income when earned

- Tracks expenses when incurred

- Shows complete financial picture

- Matches revenues with expenses

- Reveals true profitability

Perfect For

- Growing businesses

- Companies with inventory

- Businesses with credit sales

- Organizations seeking funding

- Larger operations

Real-World Example: The Bakery Story

Let's see how each method works for a bakery:

Scenario:

- May 1: Buy $500 in ingredients

- May 15: Bake 100 cupcakes ($1,000 value)

- June 1: Receive payment

Cash-Basis Recording:

- May 1: -$500 (expense recorded)

- May 15: No entry

- June 1: +$1,000 (income recorded)

Accrual-Basis Recording:

- May 1: -$500 (expense recorded)

- May 15: +$1,000 (income recorded)

- June 1: No entry (already recorded)

Pro Tips for Choosing Your Method

📊 Consider Growth Plans: Accrual becomes more valuable as you scale

💡 Review Requirements: Some businesses must use accrual by law

🔄 Think About Timing: Consider your cash flow patterns

⚖️ Evaluate Complexity: Balance simplicity with information needs

Ready to Choose Your Financial Lens?

Let's help you select and implement the right accounting method for your business journey.

Take Your Next Step:

Schedule a call to evaluate your business needs

📞 Call: (214) 306-7850 📧 Email: hello@mybizbookkeeper.com

Get crystal-clear financial insights! Subscribe to our newsletter for more accounting explanations made simple.